Currensea vs Revolut are both great card for international travel, epecially in the eurozone. That being said lets compare the benefits of each card and reach conclusion which one should you choose.

What is Revolut and why would I choose it?

Revolut started in 2015 by Nik Storonsky and Vlad Yatsenko , and since has grown in to the largest FinTech neo bank in the world with over 50 million customers.

There are multple plans for Revulut app, but we will compare free Revulut plan to free Currensea plan to keep it simplified.

What is Currensea app?

Currensea app is a new application targeted to UK citizens who who need the card to travel and spend abroad, or want to use it to pay on various foreign web-shops using variety on non pound sterling currency. Read detailed review about currensea app here: https://bankverse.ch/currensea-app-uk-travelers-best-friend/

Conclusion

After looking at all the pros and cons and comparing Currensea vs. Revolut, the best choice really depends on how you manage your money and whether you’re a frequent traveler. Currensea is great if you want something simple that works seamlessly with your existing bank account — it connects directly to it, meaning no top-ups, no headaches, and no switching between multiple apps. It’s ideal for people who travel occasionally and just want to get better foreign exchange rates compared to what their usual bank offers.

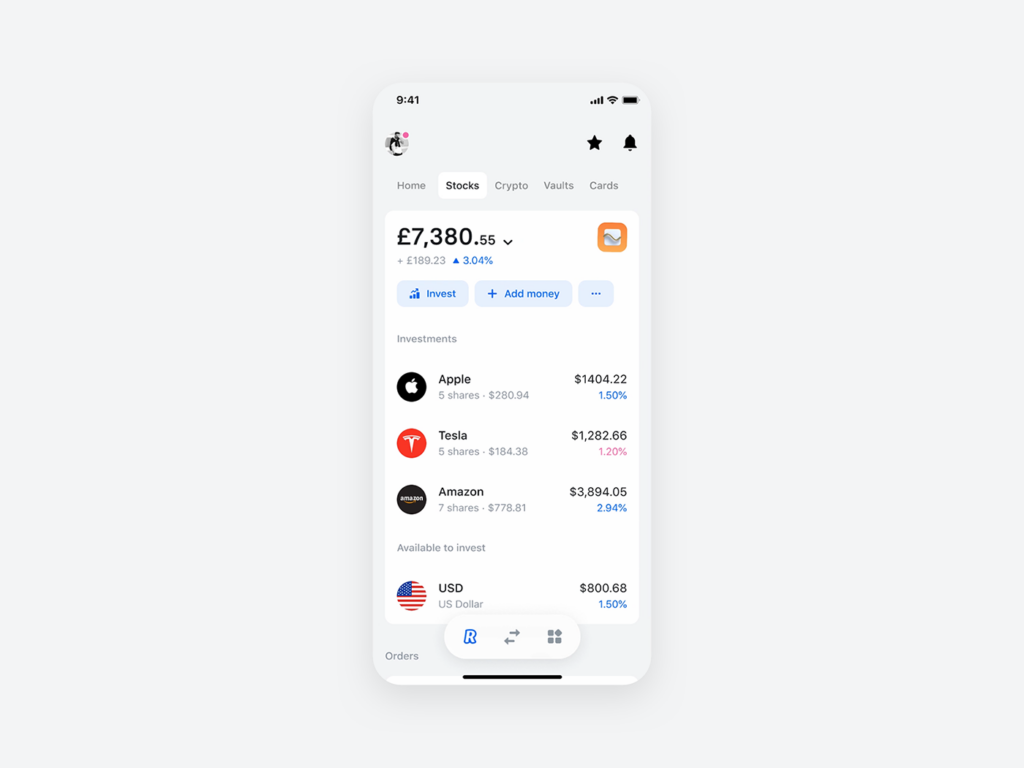

Revolut, on the other hand, is on a whole different level — it’s a full-on neo-banking app. Its feature-rich mobile platform will definitely appeal to enthusiasts and more frequent travelers who know how to get the most out of the app. You’re issued an International Bank Account Number (IBAN) for each currency you use, so you can send and receive money just like with any regular bank account. That’s one of the biggest reasons people might prefer Revolut.

If you’re into investing, you can buy stocks — even cryptocurrencies — with a single tap. For the more cautious, risk-averse type of investor, Revolut also lets you create savings vaults for your goals. Another really handy feature is the ability to generate virtual credit cards (VCCs), which are great for sketchy websites or one-off payments where you’re not sure how secure things are. You can disable these VCCs whenever you want — perfect for avoiding those annoying merchants who make it a nightmare to cancel subscriptions. There are even disposable VCCs that vanish after a single use.

So if you prefer simplicity and like sticking with your main bank, Currensea is probably the way to go. But if you’re looking for more control, features, and flexibility — Revolut might be the better fit.

Leave a Reply